Cork & Vines Fund I, LP

An Institutional-Grade Entry Point into Premium Hospitality

Cork & Vines Fund I, LP offers accredited investors exclusive access to a $20M hospitality fund designed to scale Cedar & Sage, a modern wine bar concept built for replication in prime markets.

With a 20%+ target IRR, a 5% preferred return, and structured 5-year redemption options, the fund balances attractive upside with defined liquidity.

Backed by a management team with 30+ years of resilience, seven “Restaurant of the Year” awards, and a proven track record through multiple market cycles, Cork & Vines is positioned to capture growth in the $9B U.S. wine bar market expanding at 5% annually.

Participation is intentionally limited and welcomes qualified investors seeking both near-term cash distributions and long-term brand equity in one of hospitality’s most enduring segments.

Gain Access to the Inner Circle of Private Equity Hospitality Funds

$3.5M Institutional Backing

A $3.5M commitment from Beneficient (NASDAQ: BENF) validates our structure and signals the same institutional confidence extended to our investors.

3 Thriving Locations

With three profitable locations already thriving, investors can trust a concept proven to succeed in competitive markets.

7 Restaurant of the Year Awards

Seven “Restaurant of the Year” awards demonstrate our ability to deliver enduring excellence that drives long-term brand value.

30+ Years of Premium Dining

Our three decades of leadership through recessions and recoveries prove we know how to protect and grow investor capital in all cycles.

Orange County Business Journal Recognition

Being featured in the Orange County Business Journal reinforces our credibility as trusted operators as well as a team that investors can back with confidence.

Our Growth Blueprint

The $9 billion U.S. wine bar industry, expanding at 5% annually, is powered by a cultural shift: discerning consumers are seeking elevated, premium experiences over the ordinary.

Cedar & Sage is designed to capture this demand. From the start, it was built as a scalable hospitality platform, not a single-location venture. The flagship at Stanford Shopping Center in Palo Alto proves both its market appeal and its replicability, while our operating model enables a disciplined rollout into other prime markets.

Other brands chase trends. Cedar & Sage is engineered to outlast them.

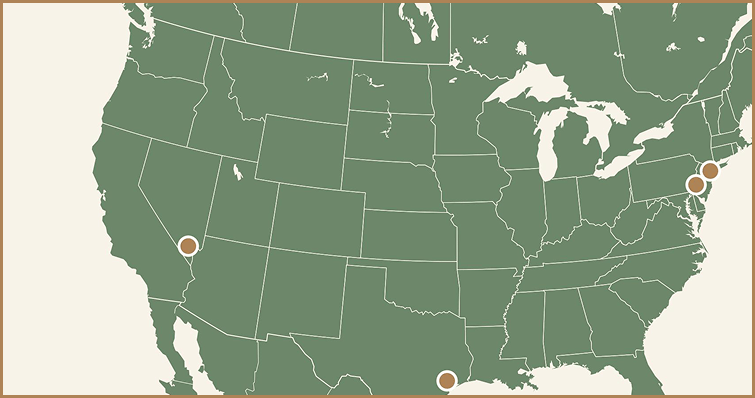

Strategic Expansion Across Prime Locations

- Miami, FL

12M+ annual mall visitors, 3x U.S. average - King of Prussia, PA

$115M+ in annual food & beverage sales - Las Vegas, NV

40M+ visitors annually - Houston, TX

2.3M+ population base - New York, NY

$140K+ average household income within 5 miles

Investment Terms

Exclusive by Scale. Flexible by Structure.

Cork & Vines Fund I, LP is intentionally structured to give qualified investors exclusive access to strong return potential, clear liquidity and flexibility. More than an investment, it’s an invitation to shape the future of elevated dining and premium wine culture.

20%+ Target IRR with 5% Preferred Return

Our return profile is designed to deliver upside and protection. Investors receive a 5% preferred return before profits are distributed, with modeled outcomes targeting 20%+ IRR, creating both confidence and compelling growth potential.

$20M Fund Size

By capping the fund at $20 million, we preserve focus, agility, and exclusivity. This ensures disciplined capital deployment and keeps access limited to a select group of investors.

$250K Minimum Investment

The minimum entry point is $250,000, a threshold that signals serious participation. Investors gain access to institutional-grade hospitality without the dilution that comes with lower barriers.

Evergreen Structure

An evergreen design allows the fund to continually capture opportunity without the rigidity of fixed fund cycles. For investors, this means long-term compounding without unnecessary structural constraints.

5-Year Redemption Options

While the fund is built for scale, investors are not locked in indefinitely. Redemption opportunities every five years provide a clear liquidity path while still supporting long-term value creation.

Return Projections & Timeline

From deployment through exit, investors can see a clear timeline of cash flow performance. Yield begins as early as Year 2, compounding with each expansion, while modeled results target 20%+ IRR through both distributions and portfolio appreciation.

Risk Factors & Mitigation

Balancing Opportunity with Strategy

While all investments carry risk, Cork & Vines Fund I, LP distinguishes itself through foresight and rigor. We anticipate challenges, engineer safeguards, and protect capital while pursuing sustainable long-term growth.

Market Cyclicality

Hospitality demand is naturally influenced by economic cycles, which can put pressure on consumer spending during downturns. The wine bar segment, however, has proven resilient by offering premium experiences at an accessible price point that customers continue to seek even in slower markets.

Our operating team has already demonstrated this resilience through the 2008 recession and the COVID-19 pandemic, maintaining profitability across locations.

Execution Risk

Scaling across multiple markets requires operational consistency, which can challenge many hospitality brands. Cedar & Sage avoids this pitfall by being designed from the outset as a replicable platform, not a one-off concept.

With 30+ years of leadership and seven “Restaurant of the Year” awards, our team applies centralized systems and tested controls to maintain performance standards across every location.

Capital Deployment

Construction delays, permitting challenges, or build-out costs can affect the pace of revenue growth. Cork & Vines mitigates this with a phased $5M annual deployment plan, which ensures both financial control and flexibility.

Liquidity Constraints

Private equity investments are less liquid by nature, which can limit investor flexibility. To address this, Cork & Vines is structured as an evergreen fund with 5-year redemption options, giving investors defined opportunities to rebalance capital.

Concentration Risk

In the early stages, a smaller number of locations can increase exposure to individual performance risks. The fund’s plan to reach 8 operating locations within 3–5 years ensures diversification across multiple prime markets. Each site is chosen for high-traffic and high-income demographics, creating demand resilience and portfolio stability.

Access Exclusive Opportunities with Cork & Vines Fund I

Cork & Vines Fund I, LP is open exclusively to accredited investors ready to help build a hospitality brand engineered for growth, scale, and sustained performance.